Housing in the News

6 local housing officials tell The Eagle what they're looking forward to in 2026

The Berkshire Eagle Dec. 31, 2025 Reported by Nate Harrington

PITTSFIELD — Berkshire County made meaningful housing gains in 2025. So what is to come in 2026?

Massachusetts' housing landscape saw major changes in 2025: Accessory dwelling units were established by right, more than half of Berkshire County's towns are eligible for special housing help as so-called seasonal communities, and the state has provided support for major affordable housing projects — all in an attempt to combat the housing crisis… The Eagle asked the leaders of several organizations about what they were proud of in 2025, and to offer a look at what they're working toward in 2026.

As Berkshire County’s housing crisis continues to spiral, Stockbridge teams up with Construct to offer rent and mortgage support

WAMC Radio 12/15/25 Reported by Josh Landes

The town of Stockbridge, Massachusetts, is teaming up with an affordable housing nonprofit to help struggling residents to pay their rents and mortgages.

Patrick White is chair of the Stockbridge Affordable Housing Trust, which is working to keep people in their homes and develop new housing as costs skyrocket and supply lags far behind demand. The Southern Berkshire town of around 1,900 residents, immortalized by Norman Rockwell in his iconic 1967 painting “Home for Christmas (Stockbridge Main Street at Christmas)”, is changing, and White says the community has to move quickly to sustain itself.

Governor Healey Launches New Campaign to Make It Easier and Cheaper to Build ADUs Across Massachusetts

ADU Design Challenge, other initiatives will help homeowners design, finance and build ADUs to lower costs

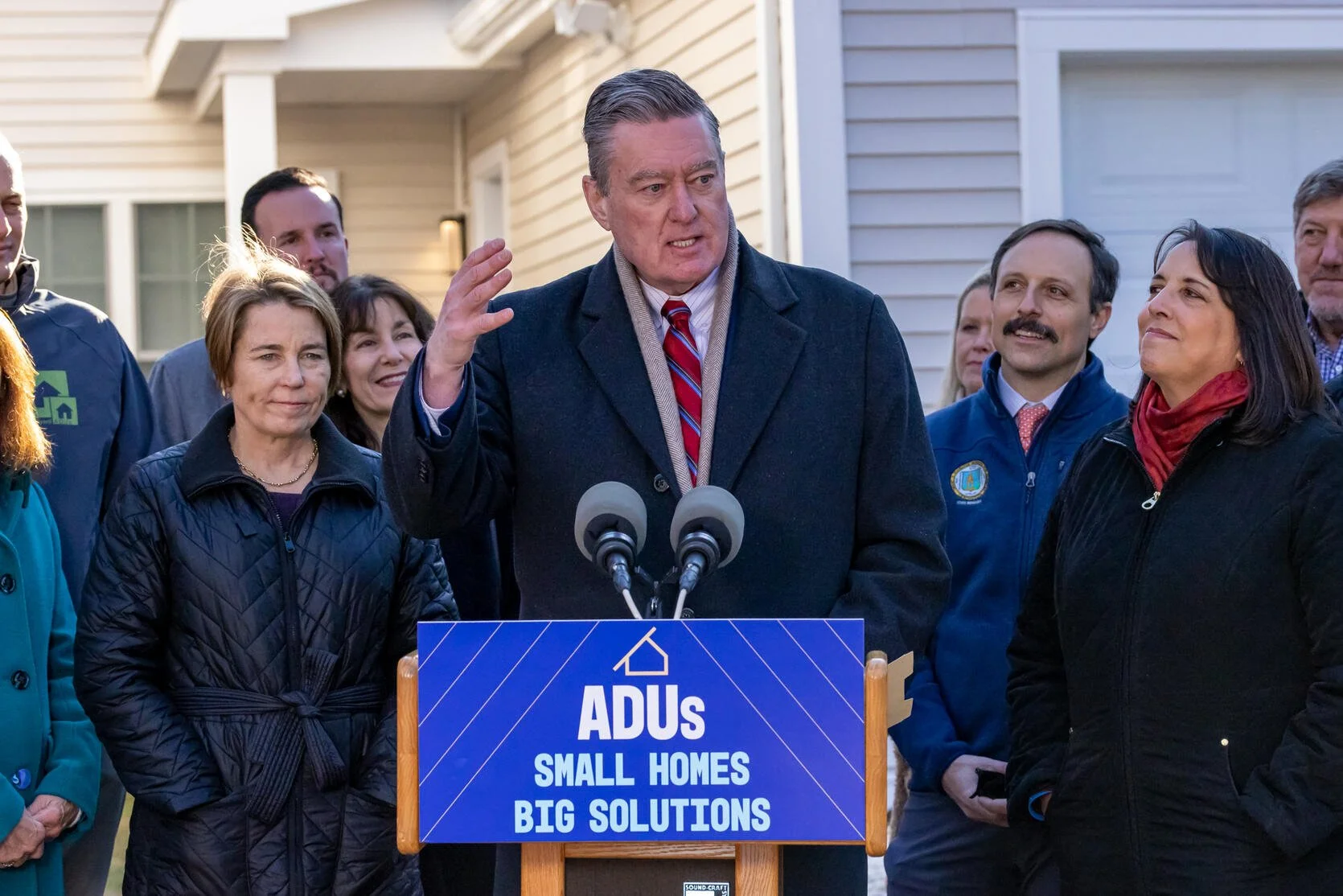

Massachusetts Secretary of Housing and Livable Communities Ed Augustus. Gov. Healey on left.

Lexington - 12/10/25 — Governor Maura Healey today announced a new campaign to make it easier and cheaper for people across Massachusetts to build accessory dwelling units (ADUs). ADUs, also known as granny flats or in-law apartments, are small residential living spaces that are located on the same lot as another home. Governor Healey’s Affordable Homes Act allowed ADUs to be built-by-right in single-family zoning districts statewide, giving communities an effective tool to increase housing production and lower costs.

Today’s announcement took place at the Lexington home of Mark and Linda Adler, who added a detached ADU in their backyard. The Adlers chose to move into the smaller unit themselves, making it possible for their daughter, a local teacher, and her two young children to live in the primary home. Their arrangement illustrates one of the many ways homeowners can use ADUs to stay in their communities, support multigenerational living and create more flexible, affordable housing options.

Accessory Dwelling Units

From State of Massachusetts website: Section 8 of Chapter 150 of the Acts of 2024 allows accessory dwelling units — or ADUs — under 900 square feet to be built by-right in single-family zoning districts.

An accessory dwelling unit is a small residential living space located on the same lot as another home. ADUs can play a significant role in our housing crisis. The ADU law allows property owners to build an ADU by-right.

ADUs can be inside an existing home, like converting a basement into an apartment, attached to a primary residence as an addition, or completely detached, like a cottage or converted garage in a backyard.

Editor’s Note: A 900 square foot ADU may seem small, but the average size of new apartments in Manhattan (built between 2014 and 2023) is 737 square feet, according to RentCafe.com, which reports on the New York City rental market.

Link to Mass.gov information on ADUs

Examples of where ADUs can be located

Egremont Municipal Housing Trust receives $100,000 from Rural Development Fund

The Berkshire Edge - Dec. 10, 2025

The Healey-Driscoll administration created the Rural Development Fund to provide funding for communities with populations under 7,000 residents. Egremont was one of 54 such communities in the Commonwealth to receive grants from the fund this year. According to a press release from the town, “[m]onies from the RDF help small communities maximize their assets and take advantage of opportunities—covering activities to boost economic revitalization, including new infrastructure that supports urgently needed affordable housing and business growth.”

The town will use these funds to complete necessary pre-development site work for the Municipal Housing Trust’s first four-unit affordable-housing cluster to be built adjacent to the town’s municipal complex. Site-preparation work for the development will include site excavation and grading, staking of homesites and driveways, installation of base materials for foundations, and installation of utility connections for water, septic, and electricity. A preliminary landscape buffer, composed of native trees and shrubs, will also be included created to visually separate the site from adjacent municipal activities.

“The Housing Trust is very gratified by this grant award—we are ready to move forward with creating sorely-needed workforce housing for Egremont. We’re grateful to the EOED for their support,” said Municipal Housing Trust Chair Richard Stanley.

Eagle Reels: Patrick White on the Berkshires’ housing crunch

The Berkshire Eagle - Dec. 5, 2025

Patrick White says the Berkshires’ housing shortage is approaching a breaking point and argues for zoning reforms, down-payment assistance and small-scale homebuilding to help working families stay local. White, chairman of the Stockbridge Affordable Housing Trust and a former town selectman, was interviewed by Berkshire Eagle columnist Dalton Delan.

Excerpt of Berkshire Eagle interview with Ed Augustus, Massachusetts’ first secretary of Housing and Livable Communities. Reported by Nate Harrington, 11/29/25

THE EAGLE: What are some of the housing policies coming out of Boston that you're excited about?

AUGUSTUS: One is the Affordable Homes Act, which was the biggest piece of housing legislation in the history of the state at $5.3 billion of authorization to funding to support a lot of the critical housing production, preservation, programs that we have as a commonwealth. And then there were 49 policy changes that accompanied that, and some of them were things like ADUs as a right, which the regs rolled out this past February. … And the governor is going to announce next week some additional things that we're doing as a state to spur ADU production.

THE EAGLE: Speaking of ADUs, the Berkshires only saw six applications to build one in the first few months since it became a right. What is the state doing to spur ADU production?

AUGUSTUS: I don't want to step on the governor's announcement next week. But we know that things like cost can be a barrier. How do you get access to equity in your home, perhaps, as a way to facilitate the build-out? We know wastewater and water can be barriers depending on the community. And, you know, I think sometimes we say ADUs or sometimes they're referred to as inlaw apartments. I don't know if everybody knows what they can look like and what they can feel like. And so I think one of the things that we want to find is how to get people maybe more excited about the possibilities. I've had a chance to visit some myself, and they are unbelievable. Like, they're not just wood paneling with a shag rug on your basement and all of a sudden we're calling in another apartment. It's something really different. It can be.

Here's what new housing data says about Berkshire County's affordable housing crisis

The Berkshire Eagle - Oct. 5, 2025 - Reported by Nate Harrington

SPRINGFIELD — Newly released data on the housing crisis in Western Massachusetts reveals that Berkshire County faces significant hurdles to alleviating it. In the county, 12 percent of housing units are seasonally vacant, 2.5 percent of units are short-term rentals listed on sites like Vrbo and Airbnb and the county is short nearly 2,000 housing units in total.

This data is part of a 132-page report released by Way Finders and the University of Massachusetts Donahue Institute during an event in Springfield. The report dives deep into the housing challenges Western Massachusetts faces that are much different than those in the eastern part of the state.

MassHousing Announces Expanded, Statewide Down Payment Assistance Program

BOSTON – June 11, 2025 – MassHousing announced today the expansion of the Agency's Down Payment Assistance (DPA) mortgage program. MassHousing’s expanded DPA program now offers up to $25,000 in down payment assistance to all income-eligible first-time homebuyers, when purchasing a first home in any city or town in Massachusetts. MassHousing now offers the largest statewide homebuyer assistance program in Massachusetts for moderate- and middle-income homebuyers.

"Down payment assistance is a vital tool for empowering first-time homebuyers and advancing MassHousing’s commitment to expanding access to homeownership," said MassHousing CEO Chrystal Kornegay. "By growing our leading down payment assistance program to reach more middle-income homebuyers statewide, we will grow consumer buying power and help ensure that homeownership remains accessible to working families across Massachusetts."

"Middle-income households now have statewide access to up to $25,000 in down payment assistance financing – a significant boost that brings first-time homeownership within closer reach, in every Massachusetts community," said Mounzer Aylouche, Vice President of Homeownership Programs.